The Forex trading market is one of the biggest markets in the world, especially when it comes to trading volumes. The movements of different currencies decide what certain products will cost at certain places in the world.

Getting this right can result in gains of billions of dollars. Forex trading is also one of the few avenues in the world where central banks participate actively. This is because they need to prevent volatility in the country’s currency. As a result, the stakes are unusually high in forex trading, and getting your trades right may yield massive profits.

Let’s see how forex traders execute their positions. There are mainly two markets in which forex traders participate. First is the spot market, where currencies are traded based on the existing prices. Those prices are often decided by supply-demand dynamics and are calculated based on several factors, including current interest rates and economic performance.

When two parties agree on a certain price, the finalized deal is known as a “spot deal.” In this deal, the first party agrees to deliver the currency of a certain amount to the second party at a rate that both decide upon in advance.

The second type of market is called the futures market. Here, unlike the spot market, the underlying currencies themselves aren’t traded. Rather the futures or forwards contracts based on these currencies are traded. These contracts allow the participants to arrive at a certain price at which they will trade the currency at a future date.

What are options?

As we got to know the spot and futures market, let us move on to a brief understanding of options. Options are slight modifications to the futures discussed above. Options too don’t involve trading the currencies directly but rather the right but not the obligation to buy or sell them at a certain price in the future.

Broadly, there are two types of options. First is the call option. When a trader purchases a call option, they purchase a right to buy the underlying currency at a certain price. This price is called the strike price, while the price at which the currency actually trades is called the spot price. This option is valid for a certain period, and the last date of its validity is called the expiry date.

For example, a call option on EURUSD with a strike price of 1.10 with a 1-month expiry means that the holder of the option has a right to buy EURUSD at 1.10 within one month, regardless of the price at which EURUSD is actually trading in the market. So, if EURUSD is trading at 1.20, the trader can purchase it at 1.10, sell it at 1.20 in the spot market and earn an instant profit.

Put options are exactly the opposite of this, where they give the holder the right to sell the currency at a certain price. How do options offer high leverage? Here’s the interesting part – the options themselves, i.e., the right to buy or sell the currency, are available at a very low price. So the option to buy $1000 EURUSD at 1.10 will be available just for around $20! This means that you can make a $1000 notional trade with just $20 in your account. This way, huge profits can be made from a small capital.

The non-linear payoff in options

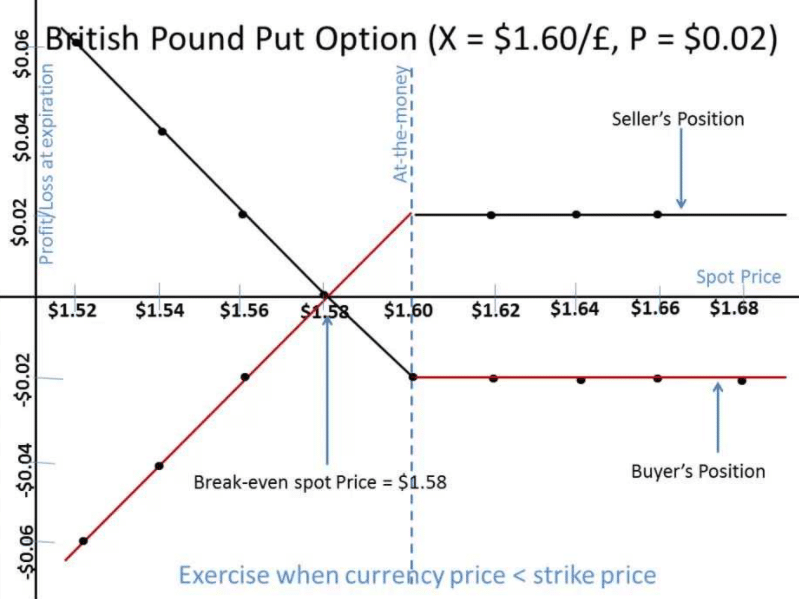

This is called the concept of non-linear payoff. Let us try to understand this concept in mathematical terms. Below is a ‘payoff diagram’ of a put option on GBPUSD pair. As discussed earlier, a put option gives its buyer the right to sell the underlying currency at a certain fixed price. In this case, the strike price is 1.60. This means that the buyer has the right to sell GBPUSD at 1.60 no matter what its price is in the spot market.

So it is obvious that the buyer of this option stands to benefit if the currency falls below 1.60. Moreover, the lower this currency falls, the higher the profit will be. If the currency falls to 1.50, the trader can buy it at 1.50, sell it at 1.60, and pocket a profit of 10 cents. If you notice, the price of this option is only 2 cents. So the trader’s profit will be five times the initial cost.

If the price falls further below 1.40, the profit will increase by 10 cents, i.e., it will go from the initial 10 cents to 20 cents. The profit in absolute terms has doubled. But think about the profit in terms of the initial cost, which was just 2 cents. A 20 cents profit would mean ten times the return.

So, just a 10 cent move in GBPUSD made the profit ratio grow from 5 times to 10 times. This is what we mean by a non-linear payoff. The profits grow exponentially even with a linear movement in the price of the currency.

Final thoughts

Options provide the trader with the opportunity to gain exponential returns from a small initial capital. However, one must be careful while trading the options since the probability of making profits from options is typically lower. As a result, one must best only on high conviction trades. Selling the options is also another way traders earn money. However, in this case, the chances of losing a large amount exist, and hence option selling should be done with caution.

Due to a certain level of sophistication required in options trading, not all retail forex brokers provide the platform for options trading. It is necessary to do some background research on the brokers if one wishes to do FX trading in both the spot and the options market.

Additionally, because options selling can involve significant risk, brokers might demand that traders maintain high margins if they intend to sell options. But options buying has a very little scope of losing money and hence doesn’t require any margin.