No economy in the world is self-sufficient as they all rely on one another for growth, trade, and stability. The U.S. being home to one of the biggest economies is no exception. America depends on other countries for goods it does not produce or are inadequate within its borders. Similarly, its biggest trading partners are China and Japan, which also account for its biggest bond holdings.

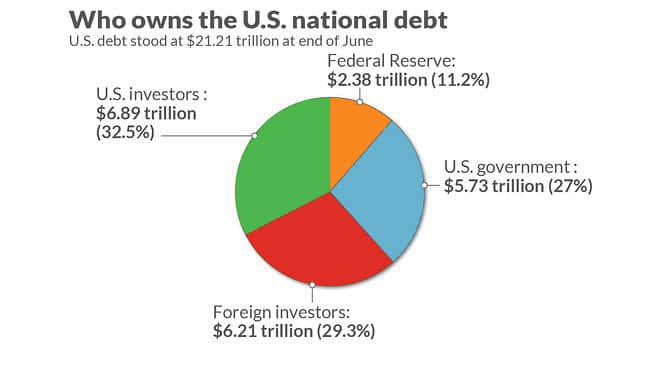

While America owes Japan the biggest debt, China comes a close second, accounting for about 4% of its total $28 trillion national debt. Most of the Chinese debt comes in the form of U.S. Treasuries that Beijing has been accumulating over the years.

Economy interdependence

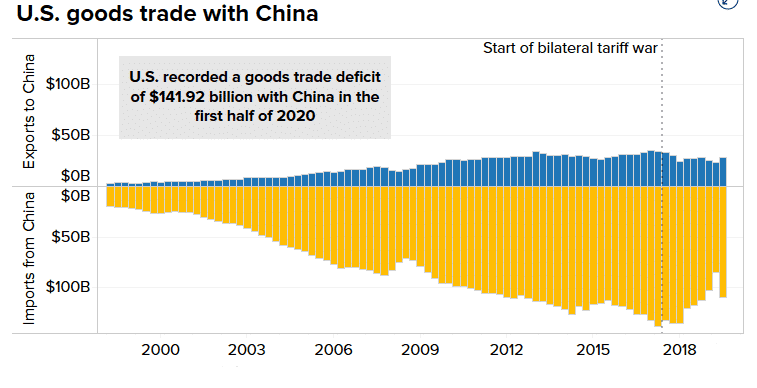

China is the world’s biggest exporter, backed by a robust manufacturing industry. The country sells more than it imports, thus the export-dependent economy claims. For the longest time, the communist nation has been exporting more than it imports to America, consequently running one of the biggest trade surpluses.

For the United States, it is a trade deficit accumulated over the years to the point of arousing concerns and a fierce trade war characterized by trade tariffs in recent years.

Whenever Chinese exporters export goods to the United States, they are paid in USD, which they must convert to Chinese yuan to cater to labor costs back at home. By selling the dollars, they increase their supply in the market as yuan demand increases. Strong demand, if left unchecked, can result in significant appreciation, making it stronger than the greenback.

Strong yuan debacle

A stronger yuan is the last thing that Beijing needs to sustain the export-dependent economy. The People’s Bank of China is usually forced to buy the dollars from the exporters, to avert significant appreciation. Therefore, reducing the U.S. excess supply in the market. By printing more to buy the dollars, the value of the yuan often depreciates against the greenback.

A depreciated RMB is usually good for the Chinese economy as it makes exports cheaper, allowing the country to export more goods. The need to keep goods competitive has always forced the PBOC to print more money to increase market supply.

If the PBOC stopped buying dollars, the yuan rate would appreciate making the country’s goods quite costly and less competitive.

Foreign reserves

China had approximately $3 trillion in foreign exchange reserves as of 2020, with a good chunk of the reserves in the greenback. High USD foreign reserves stem from Beijing’s continued purchase of the greenback as part of the yuan regulation scheme.

A good chunk of the USD foreign reserves is often invested in U.S. debt securities. The investment has allowed China to earn a risk-free rate. Increased investments in Treasuries stem from their relative stability and that they are considered safer than any other asset in the financial market.

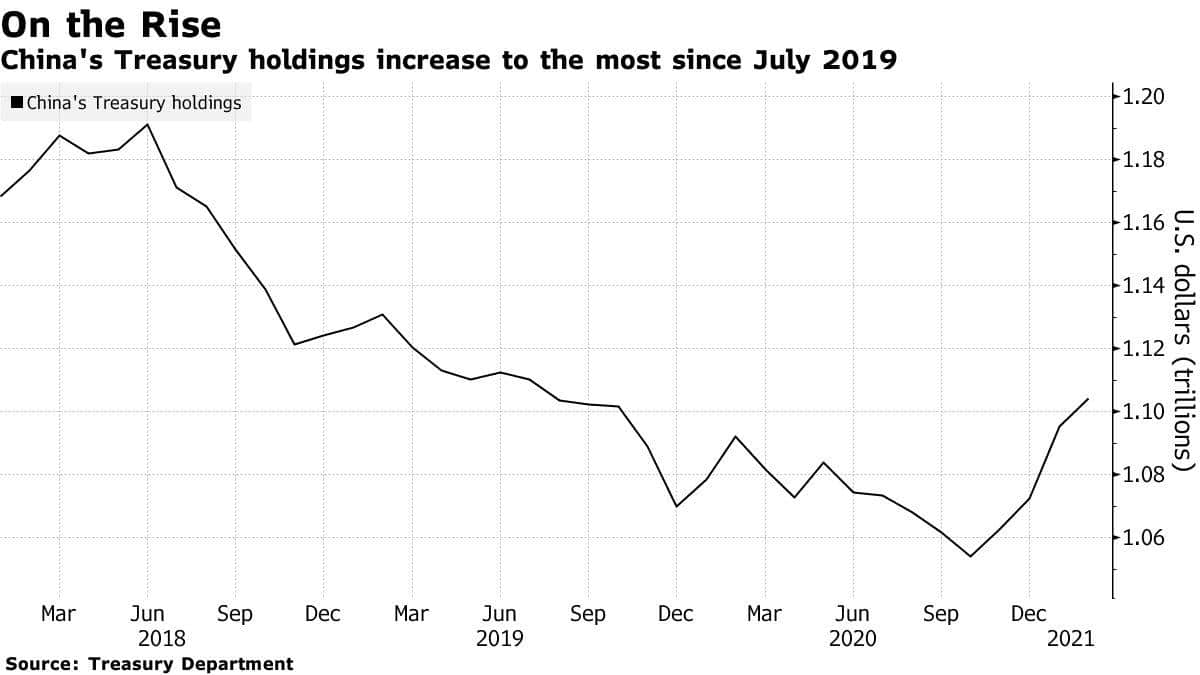

China’s holdings of U.S. debt rose to the highest level in February 2021 by $9 billion to $1.1 trillion. The increase came as the economy bounced from the pandemic much faster than the United States.

Increased exports into the United States early in the year saw Chinese exporters receive more dollars for their goods which the PBOC bought and used to purchase Treasuries.

In contrast, Japan’s debt holdings in the United States have declined by $18.5 billion in February to $7.1 trillion.

Why China continuously invests in the U.S. treasuries

While Beijing can still invest in European debt, it has often shunned them in favor of America’s debt securities as the E.U. is still considered unstable relative to the United States economy. The uncertainty of whether the Eurozone will continue to exist in the years to come after the Brexit debacle also continues to affirm strong belief in United States bonds.

While Beijing can still invest its foreign reserves in other asset classes such as real estate, stocks, and other countries, such investments are considered risky and unstable relative to U.S. bonds.

The size of the United States deficit with China is another reason Beijing is continuously investing in Treasuries. The monthly debt currently stands at between $25 billion and $35 billion. Given the increased amount of greenback at its disposal, Beijing is usually left with no option but to buy bonds to enhance the money supply. The investment also allows the Asian nation to bolster its creditworthiness.

The impact

Increased investment in Treasuries offers the safest storage or haven for Chinese foreign reserves stockpiles. Additionally, such investments keep America coming to China for more goods that it does not produce or are inadequate.

Increased Chinese loans are another reason America has continued to hold on to China as its biggest trading partner. The result has always been a win-win situation for both economies. Chinese exporters can gain access to a massive export market for their goods. At the same time, the United States can benefit from economically produced items that would be expensive to produce within its borders.

The risks

China’s massive holdings of the U.S. debt also possess significant risks. For starters, if Beijing were to elect to stop buying or selling a small portion, the net effect would be disastrous. Treasury prices would fall significantly, and yields would rise.

Rising yields would be disastrous as the cost of borrowing would increase significantly, leading to slower economic growth. Holding a significant amount of America’s debt also leaves the nation vulnerable to decisions by Beijing. Likewise, China would also feel the pinch if it stopped buying. The country buys U.S. bonds to depress the value of its native currency. Therefore, slowing or stopping purchases would result in RMB appreciation, making its goods expensive and consequently losing demand in the market.