Currency trading has given rise to one of the biggest marketplace open 24 hours a day, seven days a week. The market remains open round the clock thanks to three trading sessions in three crucial financial hubs.

24-hour marketplace

Time differentials between different financial hubs are the reason the forex market is opened 24-hours. As soon as the sun rises in Asia, the financial markets are up and running even as traders in Europe and America remain dead asleep. Similarly, as soon as European markets come online, Asia is winding down with the end of the European session, paving the way for the North America session.

Trading Sessions exist and are supported by many international banks operating multiple offices around the globe. Given that they are at the heart of transactions on the international scene, the banks can process foreign exchange orders any time of day.

While banks operate at regular business hours at each regional office, the time difference between different jurisdictions means there is always an office open and processing foreign exchange transactions.

Likewise, any city worldwide with a major financial hub, be it in Asia, Europe, or the Americas, gives rise to a key foreign exchange session. Similarly, there are three main trading sessions in the $6 trillion marketplaces.

- Asia Trading Session

- Europe Trading Session

- North America Trading Session

Asia or Tokyo trading session

Once the market breaks for the weekend, the first session to come live in the Asia session, Tokyo mostly dominates the session, considered a financial hub for forex transactions in the region. However, other hubs, including Australia, China, and New Zealand, account for the Asia session.

The Tokyo trading session goes live at 00:00 every single day and ends at 06:00 GMT. The session offers traders an opportunity to gauge momentum early in the day; conversely, develop strategies as other sessions open up throughout the day. However, given the limited number of participants during this session, the Tokyo sessions account for just 6% of the FX transactions that take place on any given day.

European trading session

European trading is often referred to as the London trading session as the UK capital is considered a financial hub in the region. Trading activity in the session begins as the Tokyo session is winding down at 08:00 GMT.

The European session is much bigger than the Tokyo session as it accounts for more than 30% of transactions that take place in the marketplace. The session also accrues its edge given that a good number of large banks at the heart of activities in the marketplace keep dealing desks in London.

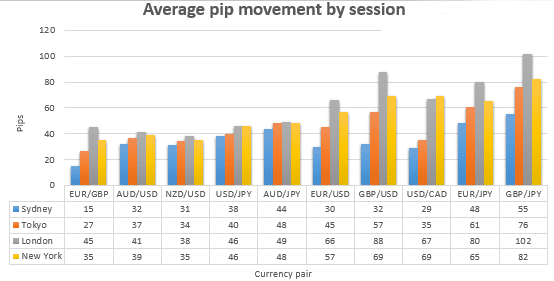

Given the size of the market and the increased number of participants, liquidity during the London session is usually high, which greatly increases the average hourly move of currency pairs. The EUR/USD pair is the most traded pair during this session.

US trading session

The US trading session is often referred to as the New York session as the state is a global financial hub. New York handles about 16% of the total forex transactions on any given day. Many of the transactions occur when both the New York and the London sessions are open concurrently.

The US trading session comes live every day at 13:00 GMT when the US market is opening up. The session overlaps the London session for 4 hours as activities in Europe wind down at about 17:00 GMT. During this time, the Asia markets are closed for several hours.

While most of the activities during this session are influenced by developments in New York, Canada, Mexico, and other South American countries also have a significant influence.

Overlaps in forex session

Overlaps occur whenever two sessions are open and running concurrently. The overlap occurs when the Asian and European sessions are open and running at the same time. During this time, traders pay close watch to cross currencies. During this session, some of the most traded pairs include the GBP/JPY and the EUR/JPY.

Overlaps also occur when the London and New York session is up and running concurrently. This has proved to be the most active session in the market given the increased number of market participants. The EUR/USD and GBP/USD pairs experience heightened activity when the two sessions are running concurrently.

When is the best time to trade

The best time to trade comes down to several things. For starters, it depends on the trading strategy and what a trader wants to achieve. It also depends on the currency pair one wishes to trade. For people not fond of high liquidity or volatility, then the best time to trade on any given day is between 19:00 and 11:00 GMT.

During this time, the liquidity is relatively low, and markets are relatively stable with no wild swings. The lack of wild swings makes it possible to use range-bound strategies as prices tend to oscillate between support and resistance levels.

Likewise, this would be the perfect time to trade European currencies like the US session winds down, and the Asian session comes back online.

However, for day traders, heightened volatility and liquidity is crucial as they give rise to ideal trading conditions. Likewise, the best time to trade in this case is when the European session comes online and when it goes offline between 08:00 and 17:00 GMT.

The heightened volatility during this period makes it possible to profit from breakouts as currency pairs experience wild swings. Whenever the London and New York sessions overlap, it gives rise to ideal trading conditions and opportunities given the enhanced volatility and liquidity.

Bottom line

Despite being a 24-hour marketplace, the forex market is split into three key sessions Asian, European, and North American sessions. The session ensures the vast forex market remains open throughout the day from Sunday to Friday. Whenever one session goes offline, the next is already up and running.