We often hear different statements about leverage in forex surrounding how high amounts of it are dangerous and how it increases the risk of account blow-ups. Although these theories are true in many cases, leverage is nothing more than a tool, and like any tool, it should be used responsibly.

Without leverage, a lot fewer people would be trading the forex markets because only a handful can afford to execute positions with large starting capital. Therefore, there is a financial incentive for both brokers and traders alike.

So, how does leverage work? Is it a dangerous thing, and is there a right leverage ratio to use? Let’s have a look.

How does leverage work?

Leverage is nothing more than the capacity to ‘gear’ a trading account to open larger positions than it would normally. Each broker administers this setting before one opens an account with them, and this is adjustable according to a trader’s wishes.

In many cases, brokers provide far less leverage to those trading significantly larger volumes than usual. In forex, we trade specific units of a base currency (the currency on the left side of a pair) represented by specific position sizes.

The four main positions we can open are standard (100,000 units; 1), mini (10,000 units; 0.1), micro (1,000 units; 0.01), and nano lots (100 units; 0.001). Now that we’ve grasped the different lot sizes (which will better help us understand how leverage works), let’s look at a practical application of this concept.

Leverage example

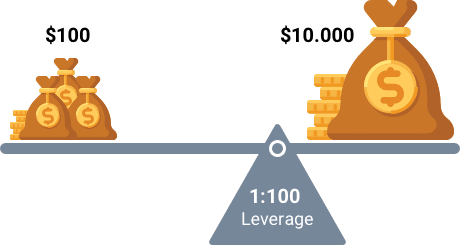

Let’s assume one was looking to buy a mini lot of EUR/USD at 1.20530. Usually, the trader would need to have $10,000 in their account to open this position. With leverage, it isn’t necessary to have such a large deposit for this order.

Let’s imagine a broker offered 100:1 leverage. This effectively means the trader can ‘gear’ their account 100 times where they would only need $100 (10,000 divided by 100) in their account to open the same mini lot on EUR/USD.

Two typical scenarios may arise from this scenario emphasizing the adage of leverage being a double-edged sword. In a mini lot, each pip is worth $1. On the one hand, let’s assume EUR/USD moves from 1.20530 to 1.20580 (50 pip difference).

If the trader closes the order at the new price, this nets them an impressive $50 ($1 X 50 pips), effectively a 50% return. In the opposite scenario, if the market instead moves to 1.19480 (same 50 pip difference), the trader’s account would reflect a floating loss of $50, an astonishing half of their equity.

If the price went against them at least 20 pips more, their account is now at the risk of being liquidated. So, we can clearly observe that leverage, when used skilfully, can magnify gains, but if utilized irresponsibly, it also amplifies losses in equal magnitude.

Fortunately, brokers offer different leverage ratios traders can utilize. Also, position size calculators have made life easier as they can automatically calculate the monetary risk in line with our equity and leverage.

Is leverage a dangerous thing?

Even if a trader has access to 1:500 leverage, this doesn’t necessarily mean they are obliged to use it all. Think of a car; although cars can reach top speeds at least above 250km/h, there is no need to drive it that fast unless one is competing professionally.

Traveling this fast increases the risk of severe injury and even death. In a similar vein, leverage itself is not a dangerous thing if the trader practices caution and understands that just like driving a car for non-competitive purposes, there is no contest in forex.

Therefore, traders are usually flexible at adjusting this to levels they are comfortable with.

How much leverage should a forex trader use?

There has been a seemingly never-ending debate over what the right leverage ratio is, even though this question has ambiguous implications. Ultimately, higher leverage should represent better skill and experience.

It’s very uncommon for a beginning or less experienced trader to use anything above 1:100. Most trading literature leans towards this figure as the benchmark for the professionals, even though there is no scientific reasoning behind this.

Thus, there is no hard and fast rule set in stone on a so-called proper leverage ratio because it depends on a multitude of factors. The leverage ratio doesn’t matter as much as understanding and being comfortable with the monetary risk per position.

A trader can blow their account with leverage lower than 1:100 if they use disproportionally large position sizes, dispelling the commonly-held belief that leverage alone increases the chances of this happening.

As mentioned previously, no trader is forced to use all or even a large portion of leverage.

Final word

Despite all the naysayers, leverage in forex is a win-win for both traders and brokers due to the financial incentive. Without this tool, considerably fewer people would be trading forex, meaning fewer customers for brokerages and the industry overall.

If we were trading on a 1:1 basis, due to the notional value of currencies, we would need significantly more starting capital, something that many cannot afford. One of the main attractions for trading this market is getting significantly better returns than parking money in a savings account or even trading other instruments.

Fortunately, one can choose a suitable leverage ratio that aligns with their monetary risk on a trade-by-basis. The leverage ratio is not as important as knowing what you’ve risked in dollar (or currency equivalent) terms because a trader using relatively low leverage like 1:10 can still blow their accounts with irresponsible money management.