The forex market particularly stands out as compared to other popular markets such as stocks and bonds. This is because, unlike the rest of the markets, in forex, one needs to take into consideration a multitude of factors. These factors include macroeconomics, geopolitics, and domestic politics, and of course, the technical price levels. Any forex trade would involve a currency pair, which means that the trader must be aware of the dynamics of both currencies.

Although at times, one of the factors becomes the overarching driver for the currency pair, as is the case with AUDUSD. Usually, the pair is driven by the interest rate differential between Australia and the US. The relative growth and inflation dynamics are also important factors for the currency pair. But over the past couple of years, as China has started asserting more and more dominance in its relationship with other countries, geopolitics has come to the forefront.

China and trade wars

As the world has moved away from full-fledged wars, economic warfare has become one of the primary tools in geopolitics. Trade blockades and embargoes have been common for punishing certain countries. However, since Trump’s election, a new form of economic warfare has emerged – trade war. When Donald Trump enacted heavy tariffs on some of the Chinese imports, it was among the first salvos of the US-China trade war. China, too retaliated with tariffs on certain goods, and this trade war rocked the financial markets for nearly two years before two reached a temporary resolution.

The trade war split the world once again into cold war-like blocs. The ones considered in the developed or western sphere of influence traditionally ally with the US. This put them at odds with China. Among these nations, the most affected one in Australia.

Australia and China trade dynamics

Australia and China signed their first free trade agreement in 2015, known as ChAFTA. Australia is largely a commodity-producing nation. It has high agricultural productivity and is a major exporter of barley, with a significant chunk of these exports going to China. Apart from agriculture, mineral mining is also a major economic activity in this country as Australia has some of the largest iron ore, gold, and coal mines in the world.

With such high production of commodities and low population, Australia majorly exports these products. As you must have guessed, China, with its large and growing population, has a huge demand for these commodities. So, trade between Australia and China is active and has been growing rapidly over the past few years.

However, since the late 2010s, concerns were raised about China’s interference and Australia’s growing dependence. Moreover, there were major human rights concerns with China’s activities in Hong Kong and Xinjiang. There were also apprehensions that the 5G equipment being sold by Chinese companies had backdoors that allowed China to access and manipulate data.

All this, coupled with the US-China trade war, meant that Australia was compelled to take a stand. Australia initially brought stricter rules on foreign investment meant to target Chinese investments. It also put restrictions on land buying by foreigners, again meant to target China.

In 2020, the Australian government started making statements criticizing China’s human rights records and also accused it of mishandling the spread of coronavirus. China retaliated by instituting a ban on beef imports from Australia, which constituted 35% of Australia’s total beef exports. China then also levied an 80% tariff on barley which is Australia’s major agricultural export. The Chinese also orchestrated cyber-attacks on Australia’s government agencies.

Impact on AUDUSD price

It is very natural that this trade war would spill over into the financial markets as well. Any trade war, in general, is seen as a negative development for an economy, at least in the short term. Economic growth also has a direct impact on the currency. As a result, due to the escalating trade war with China, the Australian dollar saw some massive weakening.

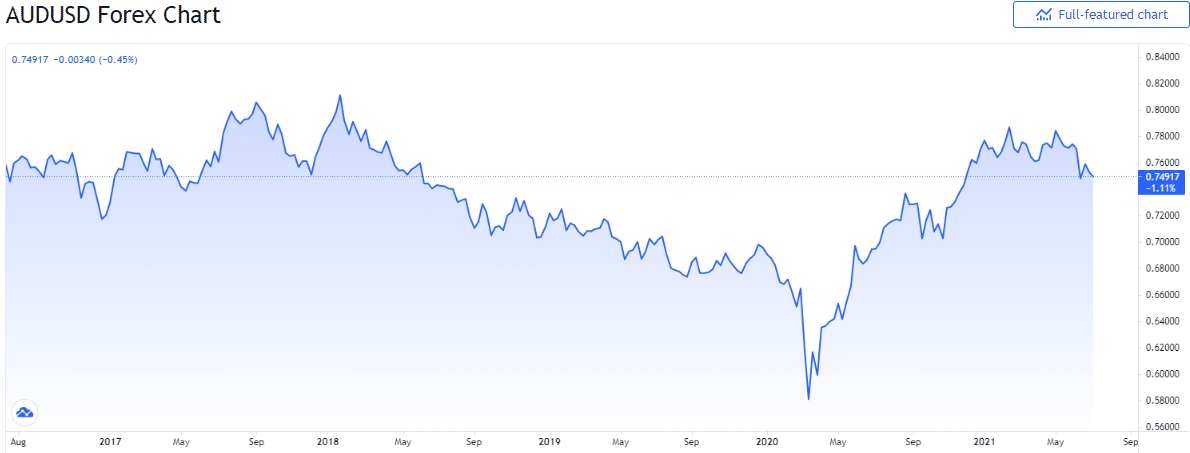

As can be seen from the chart below, from the start of 2018, AUDUSD saw a consistent weakening. The price fell from 0.81 in Jan 2018 to 0.749 at the end of the year. The slide further continued on to 2019 as well. The price moved from 0.749 to 0.692 by the end of 2019. This also resulted in the breach of the 0.70 level, which was considered to be a major and critical support.

The Covid-19 crisis further worsened this trend. As can be seen in the chart, AUDUSD saw a steep draw as the crisis unfolded. Although it also staged a recovery from those levels and since then has reversed some losses from the trade war as well. This is because there has been some thaw in the relationship between the two countries.

More importantly, so far, China has not put any tariffs or restrictions on the import of iron ore from Australia. Iron ore is the largest export of Australia to China, and in 2019 alone, China imported $150 billion of iron ore from Australia. The reasons for not putting any restrictions on iron ore are rather self-serving. China, too is highly dependent on this import. Its infrastructure push is heavily dependent on steel which uses iron ore as raw material.

But if China secures the supply from elsewhere, it can be in a position to restrict iron ore as well, in which case the impact would be disastrous for Australia. So far, both countries seem to be showing some restraint. But FX traders would do well to keep following news flow on this geopolitical hotspot as it could definitely cause some huge moves in AUDUSD.