The leading players in the forex markets

With a daily traded volume that exceeds $5 trillion, forex is the largest financial market. With such an astronomical size, it’s safe to assume that forex involves some big players contributing to the lion’s share of the markets. All market participants have different reasons for trading forex ranging from speculating for monetary gain, hedging against currency and interest rate risk to diversifying their portfolios. Forex is an example of a decentralized market. Getting the most accurate figures of the big players in such a market is not easy, though it’s safe to assume that they account for an overwhelming majority of the volume. At least ten well-known commercial banks generate much of the volume in forex.

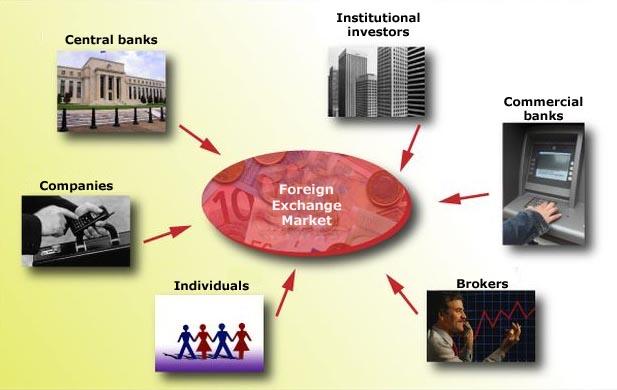

Here are the groupings below of the participants that make up forex:

- Commercial/institutional banks: Also referred to as the interbank market, they are responsible for the liquidity of the forex markets. As a result, they are known as liquidity providers and are arguably the most significant players since they provide the money that they and others trade. Banks in this regard, banks include Barclays, Goldman Sachs, Bank of America, JPMorgan, HSBC, UBS, and Citigroup.

- Central banks and governments: These are interlinked, with central banks also being one of the most prominent players. The reason is that they are responsible for the monetary policies of a country’s economy, which affect the fluctuations of any currency.

- Investment corporations: Hedge funds, private equity firms, investment banks

- Commercial corporations: Large privately-owned and publicly-traded companies, insurance companies, brokers, ECNs, etc.

- Retail traders: These are essentially everyday folk who trade their own money for themselves.

Moments of the big boys in action

When people speak about moving the market, they usually refer to the perception that the largest players are responsible for moving the market. People in the forex industry dub these individuals with terms such as ‘smart money’ and ‘market makers.’ It’s more beneficial to pay attention to the big players on bigger time-frames to gain a more long-term outlook on a currency pair. Naturally, big players are not intraday speculators trading lower time-frames. So, to trade like the big boys is to think like them too.

Quite a few events have occurred as a result of the big players in the markets. Though these are black swan events that happen every once in a while, they highlight the impact of big players and the reasons why traders have to exercise the utmost consideration to risk.

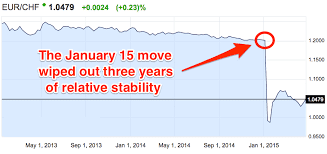

January 15, 2015, is arguably one of the most infamous days in the history of forex. The EUR/CHF flash crash occurred mainly due to the Swiss National Bank’s sudden decision to remove the peg it instilled in 2011 of 1.20 Swiss francs per euro. This decision caused panic and sent the forex markets into a frenzy that day, resulting in a colossal sum of investors and institutions to lose and gain substantial amounts of money.

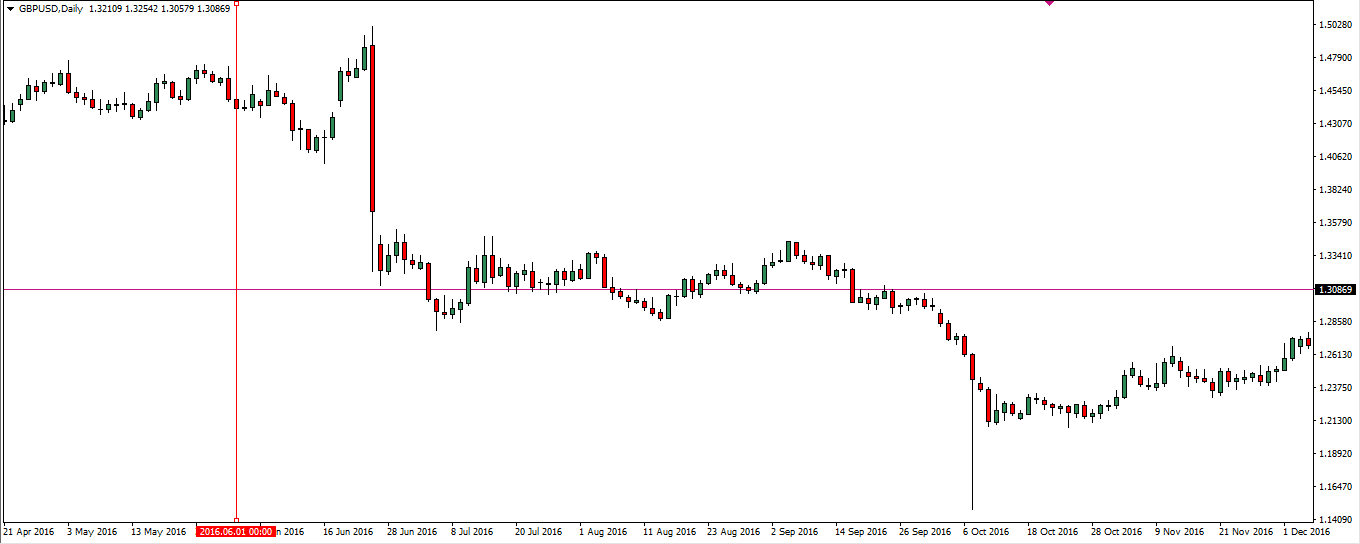

Another fundamental event that caused a significant drop in prices was in 2016 with GBP pairs as a result of Brexit. The United Kingdom decided to leave the European Union in June 2016. After this point, GBP pairs became highly volatile, which eventually ensued large downtrends. Brexit is a classic case of big institutions influencing the markets using simple fundamentals. For a good four months or so, GBP pairs like GBP/USD experienced massive drops due to Brexit.

Taking advantage of what the big boys do in forex

Several methods give us clues as to what the most prominent players are likely to do in the markets technically and fundamentally. Fortunately, most of this information is publically available for any trader on the internet published by media outlets (websites, TV, radio, social media, etc.), committees, and financial bodies.

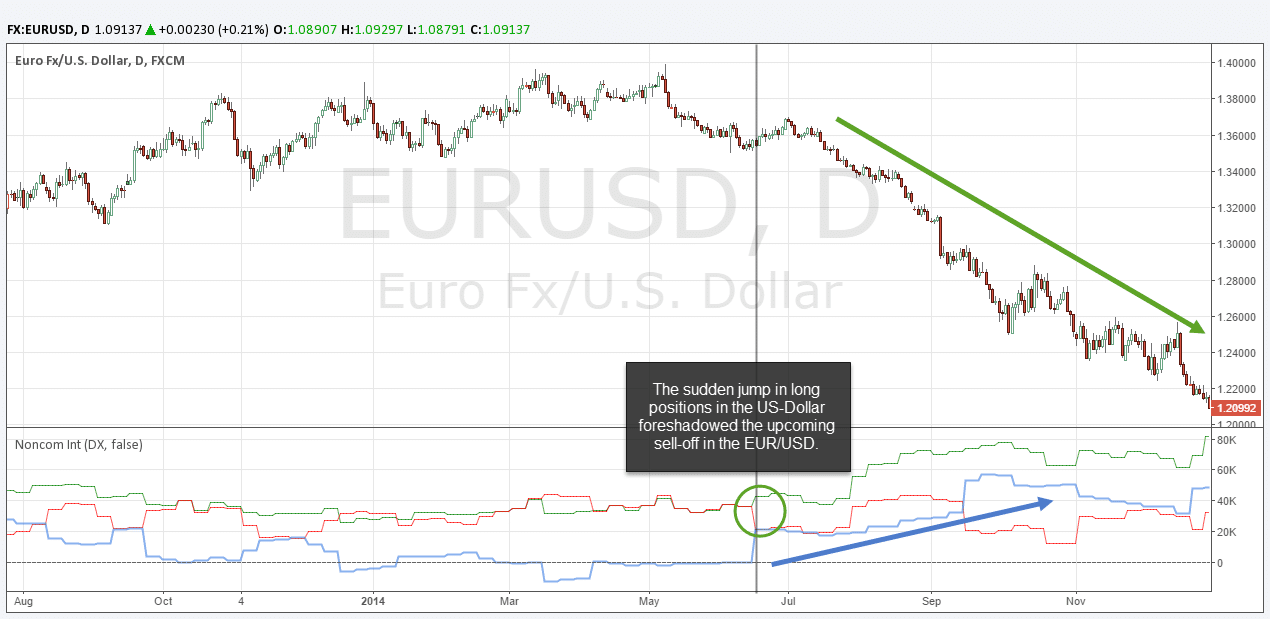

- Sentiment indicators: The most common of these indicators is the Commitment of Traders report published weekly by the Commodity Futures Trading Commission (CFTC). This report provides insights into the net short and net long positions of futures traders comprised of the big players like commercial banks and other massive financial institutions. Futures and currencies share a reliable correlation.

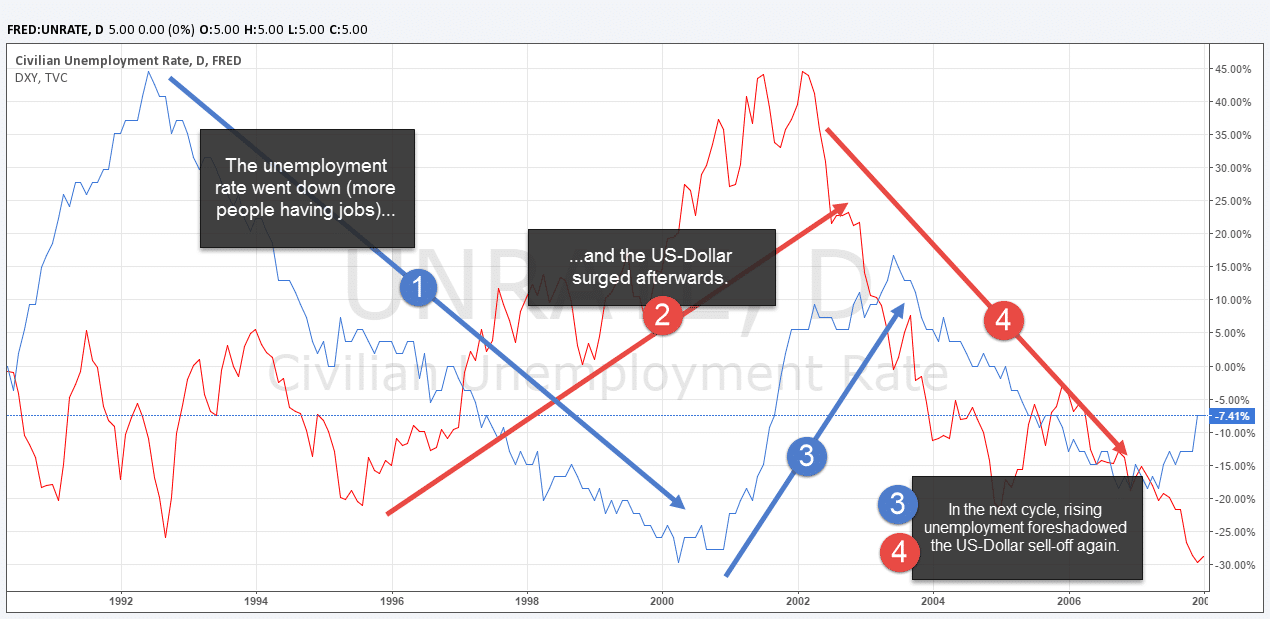

- Macroeconomic variables: These include interest rates, GDP, and employment figures, to name a few. Any noticeable shifts in some of these variables can influence the forex markets. The big players follow these variables to maintain a sentiment over a particular market for a long time.

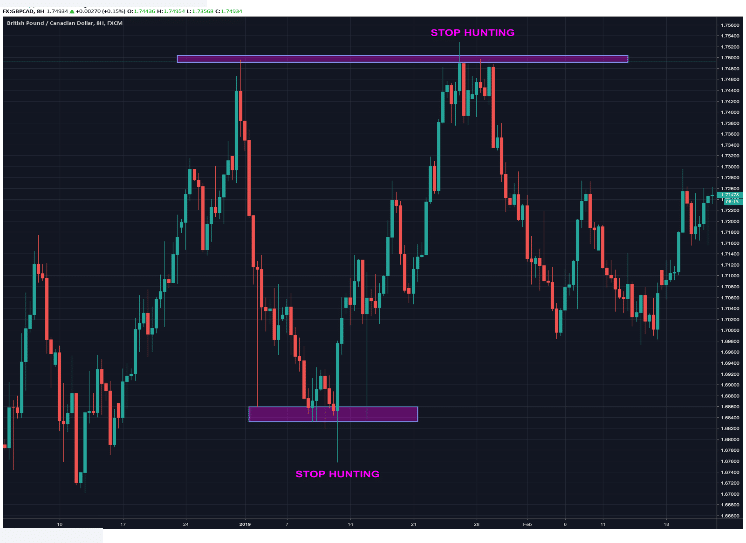

- ‘Bull’ and ‘bear’ traps on the charts: This is a phenomenon where it ‘bulls and bears get trapped’ by the big boys through shifts in the order flow. The assumption is that the principal market players can naturally influence a big portion of the order flow. There is a belief that by understanding how they accumulate orders, one can usually predict more accurately where the price is likely to go next. Most big moves in forex tend to start from areas on the charts that are exemplified by candlesticks with very sharp wicks, creating price action patterns like pin bars, spinning tops, shooting stars and hammers.

These areas where such activity also form part of the philosophy of supply and demand trading. This discovery is typically where bulls and bears are trapped either because of a false breakout or stop hunting, resulting in price aggressively going in the opposite direction. Analysts believe these realizations are mostly the result of the order flow influenced by the big players.

Conclusion

It is noteworthy to care about the most prominent players in the forex markets to some extent. As small players, the ideology is merely following these guys instead of trading against them. While we cannot know everything regarding their behaviors, there are some tips we can use to our advantage in navigating the forex world.