Along with position trading, swing trading is one approach for those interested in holding their positions for extended periods.

While most newbies understand what swing trading is, they may not yet realize some of the techniques involved in actually letting their trades run for as long as possible and knowing the risks. They often say, ‘cut your winners short and let your winners run.’

This article will cover the five considerations regarding this topic.

Tip #1: using high time-frames

One of the prerequisites for having the best chance of holding a position for extended durations is observing high time-frames. From a technical standpoint, it’s virtually impossible to find such opportunities on so-called lower time-frames.

The point of swing trading is looking for large or extended moves in the markets, an approach requiring a bird’s eye view. Although higher time-frames provide many benefits, perhaps the main one is a rarity.

What does this mean? In truth, large moves with little pullbacks or retracements are technically rare in forex due to the heavily ranging and fluctuating nature of price. Swing trading requires a lot of patience as the frequency of execution is limited.

However, when an opportunity presents itself, it usually offers attractive risk to reward. Most experts agree on anything starting from the 4-hour chart is a higher time-frame, with some arguing charts from the daily and up.

Tip #2: scaling in

One of the biggest hurdles with holding trades for long periods is knowing the precise point to lock in profits. If a trader feels a position is at a level where they would normally take profits, how should they react?

If they were to close the trade, that secures a decent amount of gains. Yet, if they exited at the wrong time and the market would have eventually continued in their favor, this can leave them feeling frustrated and regretful.

Ultimately, successful swing traders constantly balance these scenarios of knowing when to exit right before a significant retracement, having captured much of the move. In one situation, this might save them when the market does pull back significantly, meaning most of their profits wouldn’t have been eroded.

On the other hand, they might eventually see the market continuing considerably in their favor in hindsight. So, what is the solution to this problem? While not a perfect answer, scaling in is one logical method where traders have the luxury of locking in most of the profits and having the chance to let their gains run.

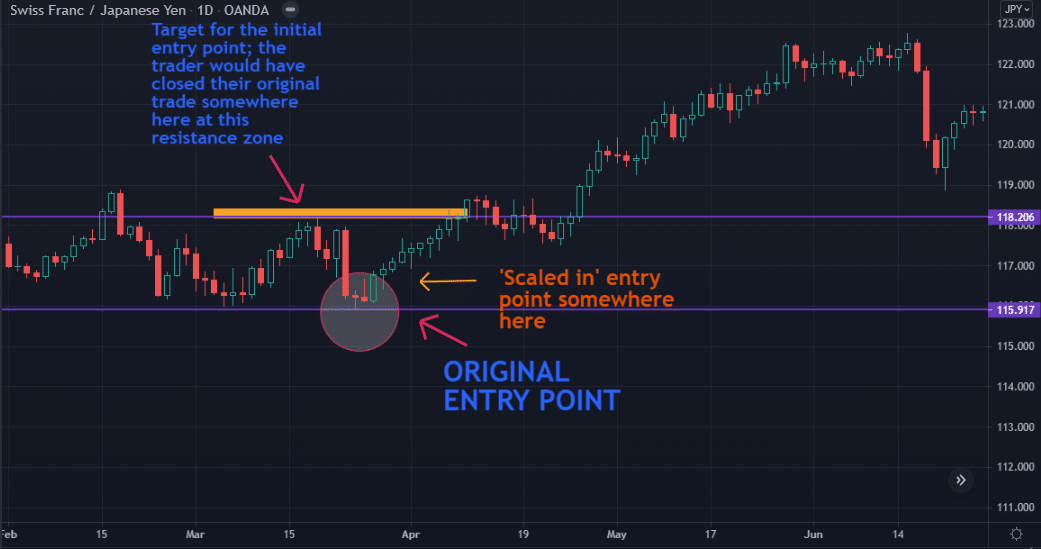

Let’s look at an example below.

- In the example above, we are looking at the daily chart of CHF/JPY. From the marked entry point, we see the price moved close to 700 pips before the big dip. Of course, no one would have known this in advance.

For a trader to have had the best chance of capturing this move, they would have entered two positions at different levels and points. The first position (marked in blue) would have been closed at the resistance level marked in orange.

They would have let the second order (the ‘scaled in’ trade) run indefinitely. Instead of relying on one position dealing with the uncertainty of how far the price could have gone, having a second one provides the best of both worlds; secured profit and the potential for more.

Therefore, what a swing trader might consider for holding trades longer is opening two positions. The first order would have a defined exit at a specific point like a support/resistance level or Fib ratio, and the other would run indefinitely while locking in profits (assuming price moves in their favor).

Tip #3: using Fibonacci for knowing where to lock in profit

After considering the advantage of scaling in, the next tip goes over the most optimal way of locking in profits. Holding a trade for any length of time means dealing with the retracements along the way.

It takes some skill and experience of knowing the areas to lock in gains at a point where the trader leaves enough room for price to move. A common mistake with many traders is using trailing stops that typically trail far too close to the price.

While ‘runaway’ trades do occur on seldom occasions, it’s always best to assume the market will pull back at some point. Another error is moving the stop loss too soon after entry. The best advice is to wait until after the market closes before doing this.

By this time, the trader should still be in a position with a little bit of profit. They would be ready to use Fibonacci retracements for moving the stop loss.

While the so-called perfect ratio for locking in profits is debatable, 38.2% is generally the best to use. This ratio allows enough room for price to move in the event of an undesired large retracement.

In the chart above, locking in the second position at this level would have allowed the trader to let it run. Of course, that scenario is not how the market will always play out, but the 38.2% makes sense as a level to observe.

Tip #4: allocating a time frame for holding

Another tip is allocating a particular time for holding a position depending on the set-up in question. As a rule of thumb, swing traders could consider the following time scales for each time frame.

- 4-hour chart: at least two weeks

- Daily chart: at least a month

- Weekly: at least six weeks

- Monthly chart: at least two months

Tip #5: understanding the risk of negative swaps

Lastly, a challenge trader might encounter incurring negative swaps, although this is more pronounced for exotic markets. Major and minor currencies typically incur very little rollover as the interest rate differentials aren’t so large.

Yet, negative swaps are likely to be an issue for exotic pairs where the differentials are more noticeable. Therefore, a trader would have to shop around for brokers with the lowest swap rates in this regard.

Some brokers can provide a swap-free or Islamic account (typically only reserved for Muslim clients) to non-Muslims. However, this is up to an individual’s company discretion. It is one of the reasons why allocating a ballpark time scale of how long a trader plans to hold is essential.

The investor would need to factor in how the negative swaps could affect their profits according to the amount of time they plan to leave their positions running.

Final word

It is every swing trader’s dream to capture the largest gain possible from their positions. As with anything in forex, knowing how to achieve this goal is a lot more art than science.

Hopefully, this article will have provided understandable and actionable tips for swing traders to profit the most from the markets.